Cart Total

$0.00

-

Your shopping cart is empty

Loading

Hello! Log in Your Account

New customer? Start here

|

3 min read

Contents

Quick Summary

Yay receives private equity investment as it accelerates channel offering with TelcoSwitch.

Private equity fund Queen's Park Equity (QPE) has partnered with Yay.com. The combination of Yay.com's impressive features and apps, combined with an advanced network architecture, delivers a platform that boasts unrivalled stability, performance, and innovation.

The investment will enable Yay.com to drive a class-leading solution to TelcoSwitch's rapidly growing base of channel partners, with a product portfolio that meets the demands of both a next generation UCaaS proposition, and the forthcoming PSTN switch-off.

Matt Mansell, Yay.com Founder & CEO, said: “The timing is nothing other than perfect to unleash the power of our platform to the channel. We can provision 1 user or 100,000 users in just seconds through our mature and feature rich platform. Combined with modern WebRTC device/desktop apps, omnichannel capabilities and much more, we will close out 2022 with a powerful punch.”

Nick Manning, Investing at QPE added: "We are very excited to be supporting Yay.com to further accelerate its growth trajectory. Matt has built a strong brand underpinned by an exceptional platform that is highly complementary to our existing partnership with TelcoSwitch."

Advisors to the transaction were:

Yay: Buzzacott (Corporate Finance) and Marriot Harrison (Legal)

QPE: Osborne Clarke (Legal), Wilson Partners (Financial and Tax), JCK (Tax Structuring) and Intechnica (Technology)

Founded in 2014, Yay.com began providing businesses with a faultless, high-quality voice platform at a fraction of the cost to incumbent solutions. The astounding response bought rapid expansion, innovative new features, and much maturity to a now long-established platform.

With thousands of public 5/5 star reviews, Yay.com now manages over 20 million calls every month, reputed as the most advanced and reliable communications platform available.

Further information on Yay.com can be found at www.yay.com

QPE is focused on providing capital and expertise to high-quality, entrepreneur-led businesses within the Tech Services, Health & Pharma and Education sectors, with an ambition to accelerate their growth. Queen’s Park Equity Fund I was oversubscribed and closed at its hard cap of £202m in Dec-20.

The QPE team, which is led by seasoned leadership with over 40 years of private equity experience, includes a fully dedicated origination team which supports the accelerated growth strategies across the partner companies they support. Furthermore, QPE has an extensive Ambassador Network of industry specific entrepreneurs to assist its management teams to deliver their plans.

Further information on QPE can be found at www.qpequity.com

Combine the Yay.com phone system with Intercom for improved customer and prospect support.

Posted December 20 2022 | 2 min

Our business SMS service is now available for all Yay.com customers, regardless of your plan.

Posted January 28 2022 | 2 min

Yay.com's VoIP phone system now supports attended transfer, dedicated apps for tablet devices and multiple users on a single mobile device.

Posted July 9 2021 | 3 min

Yay.com has been named on the CCS's G-Cloud 12 framework as a trusted supplier of cloud software with its VoIP phone system for businesses.

Posted November 25 2020 | 3 min

Our new global search function is here to empower you to find files more efficiently and to navigate the dashboard faster

Posted September 4 2020 | 2 min

Yay.com supports calls to the new Covid-19 test and trace 119 phone number.

Posted May 29 2020 | 2 min

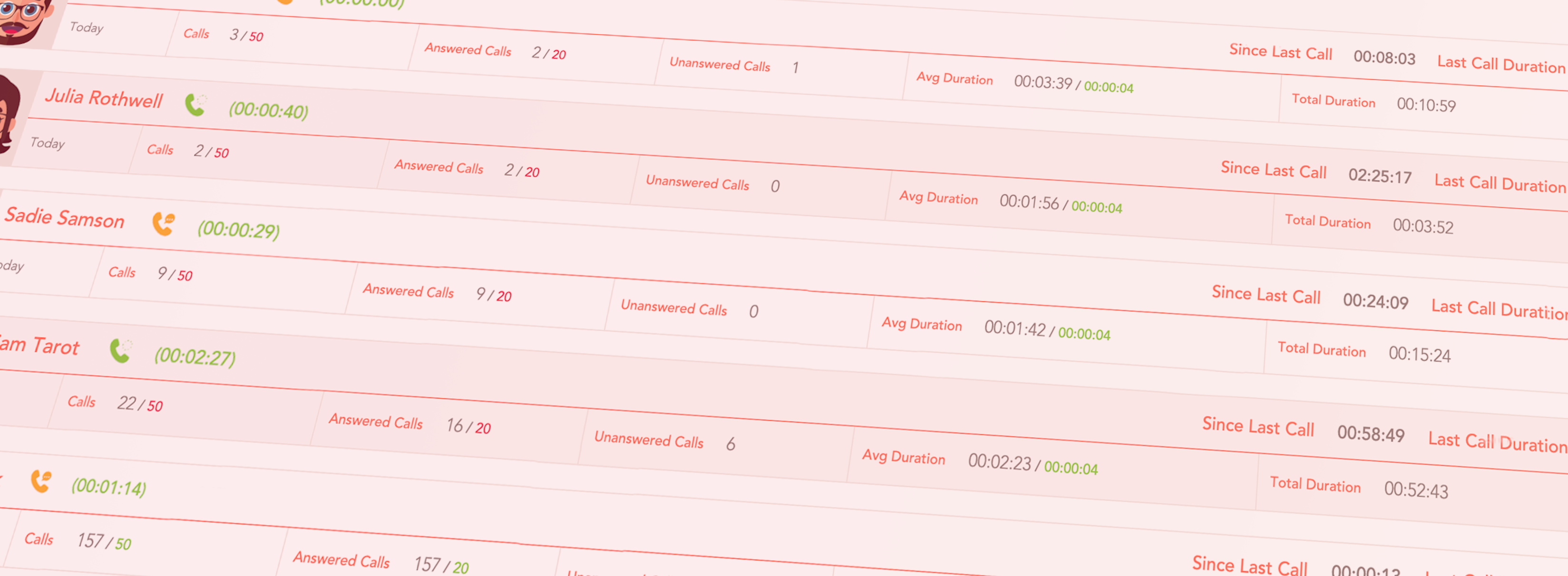

Wallboard feature expanded to display outbound call statistics

Posted February 10 2020 | 2 min

We're thrilled to support public sector entities as ISO certified G-Cloud 11 suppliers on the Government's Digital Marketplace.

Posted July 11 2019 | 2 min

Find out who Yay.com are and how we can help your business.

Posted December 5 2016 | 1 min